Geral

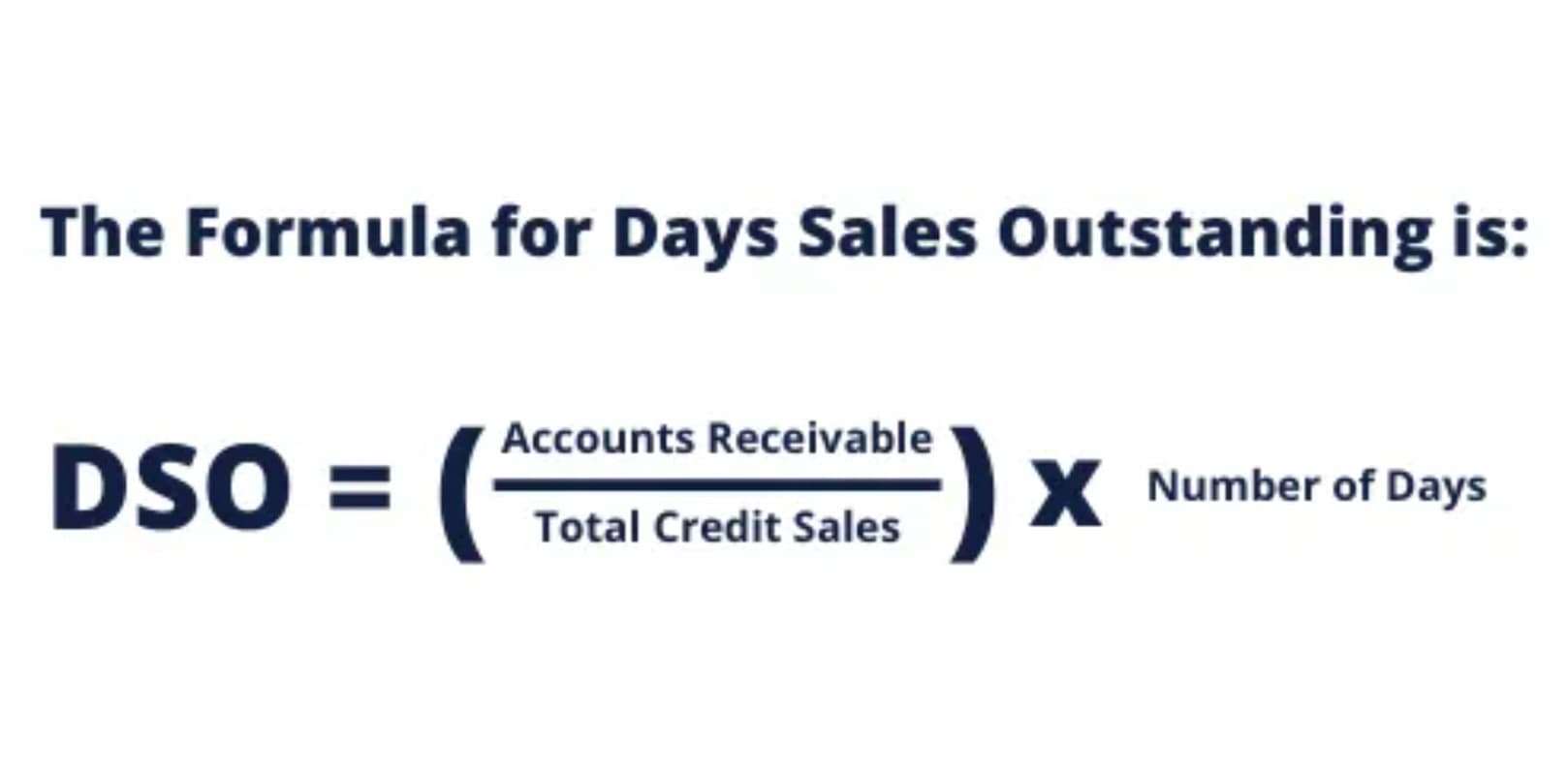

Reconciled Balance vs Balance Sheet Balance

An addition or subtraction error may have been made in one of your columns if the difference is a multiple of 10. Embrace these differences and use them as a tool to sharpen your accounting skills. Remember, https://primter.es/accounting-vs-financial-planning-and-analysis-fp-a-3/ consistency and diligence in updating and comparing records are your best allies in keeping your financial world ordered and easy to manage. Have you ever gone through your bank statement and suddenly remembered that one dinner you forgot to log?

Ledger vs. Available Balance: Differences and Implications for Financial Planning

A book balance is the account balance in a company’s accounting records. The term is most commonly applied to the balance in a firm’s checking account at the end of an accounting period. An organization uses the bank reconciliation procedure to compare its book balance to the ending cash balance in the bank statement provided to it by the company’s bank. Bank balance and QuickBooks may not match due to data entry errors, timing differences, or uncleared transactions.

Understanding the Difference: QuickBooks Balance vs. Bank Balance

Therefore, company records may include a number of checks that do not appear on the bank statement. These checks are called outstanding checks and cause the bank statement balance to overstate the company’s actual cash balance. Since outstanding checks have already been recorded in the company’s books as cash disbursements, they must be subtracted from the bank statement balance. In short, the bank balance is the ending balance appearing on a bank statement and what we recommend using to set your starting balances. For example, when an organization receives its June checking account statement from its bank, the June 30 balance will be the bank balance.

- Using the right tools can make a huge difference in balancing your books.

- A Community of users for Quickbooks Online, Pro, Premiere and Enterprise Solutions.

- Meanwhile, you’ve already logged these in QuickBooks, creating immediate deviations between both balances.

- It’s the actual amount of money you have in your bank account as updated by the bank.

- ” In this section, we will clarify what constitutes a ledger balance, how it differs from an available balance, and provide insights into the clearing time for a ledger balance.

- Bank reconciliation also aids in identifying any errors in recording, banking fees, or outstanding checks that could impact the financial controls of the business.

The Importance of Regular Bank Reconciliation

Sure, these processes might seem tedious at first, but the peace of mind they provide is completely worth it. Conversely, bank fees or interest might already be processed by your bank but not yet recorded in QuickBooks. Imagine calling out your shopping list ahead of time, but the store has already restocked some items.

Locate the duplicates in the QuickBooks register or banking feed and carefully delete or exclude them. Be sure to verify that each transaction truly is a duplicate with no unique elements before removing them. Streamlines order fulfillment, automates stock fixed assets tracking, and ensures efficient delivery management, helping businesses optimize logistics and improve customer satisfaction. Furthermore, it’s worth noting that open invoices that still need to be collected post to the Accounts Receivable (A/R) account in the Chart of Accounts. Once the invoice is marked as paid, the amount flows into the designated income account.

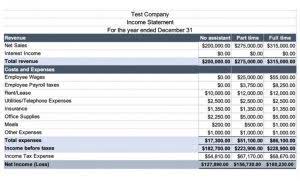

What is Accounting?

- I am having the same issue that is listed above and have tried all troubleshooting steps, including speaking with QuickBooks multiple times.

- Understanding these timing differences is essential for keeping tabs on your actual financial status.

- This could result from connectivity issues between your bank and QuickBooks.

- These might include incorrect charges, duplicate transactions, or errors in processing deposits.

- These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more.

If using downloaded transactions, have you added the payment from the bank account and then matched it from the book balance vs bank balance credit card side (or vice versa), or did you use Transfer? If not, you may have added it from both the bank and the credit card or liability account, causing duplicate transactions. I like to do the bank side first because it is generally easier than the book side. You are only dealing with outstanding checks and deposits in transit on the bank side. Add the deposits in transit to the beginning balance and subtract the outstanding checks.

- It shows the total amount of money you have, according to the transactions recorded in QuickBooks.

- If there weren’t enough funds on a examine that was a half of a deposit, the financial institution would take the money from the business’s checking account.

- These are funds the company has recorded internally but have not yet been processed by the bank.

- It serves as a crucial tool for complying with financial standards and regulations.

- For example, at the end of October, the balance in the same company’s general ledger cash account is $2,500.

- Balancing of books holds main significance for all companies or small business owners.

Two critical terms you’ll encounter in this context are ledger balance and available balance. In this concluding section, we will discuss the importance of these concepts and how they differ from one another. No, you cannot spend your ledger balance directly since it represents the total amount of money in your account at the end of each business day. You can only spend your available balance, which is the aggregate funds accessible for withdrawal or transfer at any given moment during the day. The clearing time for a ledger balance typically occurs within one business day, but the exact time may vary depending on the specific banking policies and transaction types. Understanding the differences between a ledger balance and an available balance is crucial for effective financial planning in banking and investment.

-

Televisão & Novela6 meses atrás

Televisão & Novela6 meses atrásRodrigo Faro surpreende na Dança dos Famosos ao revelar uso de enchimento na cueca

-

Entretenimento4 meses atrás

Entretenimento4 meses atrásZé Felipe e Ana Castela aparecem de mãos dadas em viagem ao Pantanal

-

Carnaval6 meses atrás

Carnaval6 meses atrásFabi Frota é a nova Musa da Escola de Samba Colorado do Brás para o Carnaval 2026

-

Carnaval6 meses atrás

Carnaval6 meses atrásJojo Todynho brinda os 40 anos de Douglas Pereira em dia de festa no Rio

-

Shows e Festivais2 meses atrás

Shows e Festivais2 meses atrásElis Justi se apresenta no Villa Country em celebração aos 28 anos da Rádio Nativa

-

Musica e Youtube2 meses atrás

Musica e Youtube2 meses atrásResenha das Braba: Música, futebol feminino e solidariedade marcam gravação da segunda edição do projeto de Day e Lara

-

Musica e Youtube4 semanas atrás

Musica e Youtube4 semanas atrásAo lado de Ana Castela, CountryBeat começa 2026 entre as músicas mais ouvidas do Brasil

-

Kids & Teens5 meses atrás

Kids & Teens5 meses atrásJoão Vitor faz estreia na telinha em minissérie inédita do SBT